If you fail to renew by 4 September 2017 your vehicle will have to be disposed of immediately. If the taxpayer is an owner on 1 January that individual has to pay the property tax even if the property is sold later.

Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

. The aggregate credit allowed may not exceed an amount which bears to the total tax payable in South Africa the same ratio as the foreign income taxable in South Africa bears to the total taxable income. Income Tax Slab Rates for FY 2019-20 AY 2020-21. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount.

This also means that if the total income of a taxpayer is above Rs. Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor. The history of the Goods and Services Tax in India dates back to the year 2000 and culminates in 2017 with four bills relating to it becoming an ActThe GST Act aims to streamline taxes for goods and services across India.

Foreign tax relief. How To Pay Your Income Tax In Malaysia. Back Taxes For Previous Year Tax Returns 2020 2019 2018 2017 etc.

At the same time the maximum tax exemption per employee is RM3000year. The discount rate is fixed by Persatuan Insurans Am Malaysia PIAM Motor Tariff. Please visit the Rebate Center for a list of energy efficiency tax credits by zip code.

1961 is available to the individuals who have a yearly income up to Rs. 12500 under Section 87A of IT Act. Uniform Energy Factor UEF.

The tax credit is for 50. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor. The implementation of the Goods and Services Tax GST in India was a historical move as it marked a significant indirect tax reform.

No Claim Discount NCD Rate in Malaysia. Guide To Using LHDN e-Filing To File Your Income Tax. The Tax forms and Calculators Are Listed by Tax Year.

For example if your COE expires on 5 August 2017 you must pay the PQP for August 2017 and late renewal fee if you renew late. KUALA LUMPUR Malaysia AP Malaysias top court on Saturday condemned as a smear attempt the leaking of an alleged guilty verdict against the wife of former Prime Minister Najib Razak days. Housing tax is established annually according to the taxpayers situation on 1 January of the tax year.

Assuming youre a sales manager who will travel to Australia to attend a trade conference. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. The dam will take 1 year to be built.

2500 provided the total income is more than Rs. Credit in the form of a rebate from South African tax is allowed for taxes paid on foreign income. Residential Gas Oil Propane Water Heater.

See how to file a 2020 Return only to claim Stimulus 1 and 2 and details on the Recovery Rebate Credit. The maximum amount of discount is capped at 55 after five consecutive years of not making any claims. Given up under the provisions of the tax incentives.

With Overseas Leave Passage the company will not be entitled to a tax deduction. Section 87A as per the Fiscal Year 2017-18 provides taxpayers with an income tax rebate of Rs. How Does Monthly Tax Deduction Work In Malaysia.

According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs. Overseas Leave Passage on the other hand is slightly different from local leave passage. Get quick answers to your federal tax credit questions regarding your Rheem water heater and HVAC system.

The longer a claim not made against your own policy the higher discount you will get. This tax is established for the year according to the situation on 1 January of the tax year. 12312017 through 12312021.

Where a country grants tax incentives to encourage foreign investment and that company is a resident of another country with which a tax treaty has been concluded the other country may give a credit against its own tax for the tax which the company would have paid if the tax had not been spared ie. Search for previous tax year forms and publications. 3 50000 during the Fiscal Year 2017-18 then that individual cannot claim tax deduction under section 87A.

Progressive Tax Know How A Progressive Tax System Works

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

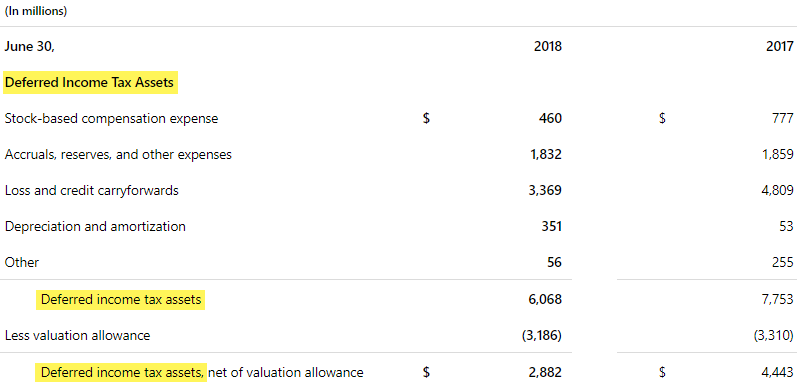

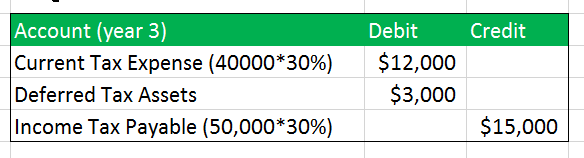

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Asset Journal Entry How To Recognize

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Corporate Vs Personal Income Tax Overview

Tumblr Lightning Photography Thunderstorm And Lightning Thunderstorms

Deferred Tax Asset Journal Entry How To Recognize

How To Amend An Incorrect Tax Return You Already Filed 2022

Tax Haven Cash Rising Now Equal To At Least 10 Of World Gdp

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Deferred Tax Asset Journal Entry How To Recognize

Tumblr Lightning Photography Thunderstorm And Lightning Thunderstorms

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How To Amend An Incorrect Tax Return You Already Filed 2022

Deferred Tax Asset Journal Entry How To Recognize